With the first semester of a new academic year about to begin, you may have children or grandchildren heading to university for their first year, or back for their next year after a summer break.

Of course, one of the biggest discussion points around university education relates to fees and costs. Universities in England and Wales can now charge up to £9,250 a year in tuition costs for an undergraduate degree.

That only covers the cost of your child or grandchild’s education, and not whatever they will need for food, rent, bills, and other living expenses.

Typically, students have two options for paying for university:

- They can apply for student finance from the Student Loans Company (SLC).

- They can ask for support from family to help them cover the costs.

You may well have always envisioned paying for your child or grandchild’s university fees. Or, you might think that student finance is a more cost-effective way for them to effectively self-fund their education.

So, find out how much university costs, and the benefits and drawbacks of student loans against paying for your child or grandchild’s education.

Student finance offers loans specifically for university goers

By applying for student finance from the SLC, students can borrow money to pay specifically for university education.

Students can apply for one or both of:

- Tuition Fee Loan – This money is paid directly to the university to cover the costs of a student’s course fees.

- Maintenance Loan – Students can also apply for money to help them pay for living costs. It is important to note that this is means-tested on your child or grandchild’s household income (essentially, their parents’ income). As a result, even if they take this money, they may receive less if their household earns a certain amount.

As with most forms of borrowing, students are charged interest on their loan. This is applied from their very first day of university.

Aside from the interest, a student loan functions very differently from ordinary borrowing.

Students only start paying back when they reach a certain earnings threshold.

These repayments are deducted directly from their income each month. As a result, many commentators liken student loan repayments to a “graduate tax”, rather than thinking about it as a loan.

Student loans will not be included in your child or grandchild’s credit report, either, so will not affect their affordability for future borrowing, such as for a mortgage.

Furthermore, it will also be wiped after a certain number of years or in certain circumstances, such as the death of the borrower. You can read more detail on this below.

All in all, this can make student loans fairly attractive, as they may not negatively affect your child or grandchild in the long term as other forms of borrowing can.

Recent changes will likely make loans more expensive for new starters

However, while taking out a student loan can allow your child to borrow money without the constraints of regular debt, there is still a cost for doing so.

This is especially true for students who started university in or after September 2023, as significant changes to the student loan system were introduced at that time.

There were three key changes:

- The earnings threshold before graduates must start repaying their loans was reduced for new starters, from 9% on earnings over £27,295 to £25,000. As a result, many students began repaying sooner, and on more of their income.

- The maximum term before the loan is wiped increased from 30 to 40 years. This means students are paying back their loans for longer, likely increasing the total amount repaid over their lifetime.

- The interest rate applied to new loans shifted from the Retail Prices Index (RPI) plus 3% to just RPI.

Initially, this was thought to reduce interest on loans, but with inflation hitting high levels and RPI reaching 13.5% in March 2023, the government decided to cap RPI interest rates at 8%. Though this percentage is reviewed each month, the 8% interest rate has remained set.

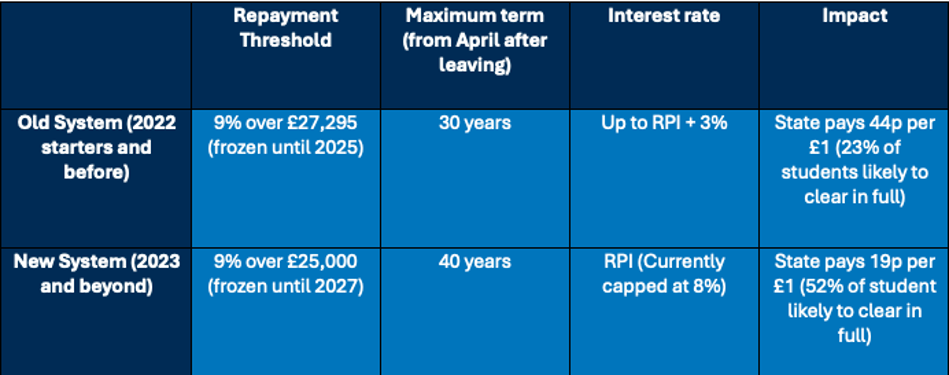

The table below illustrates how these changes affect new students compared to those who were already studying under the old system:

(Source: MSE)

As an example, a graduate in England with a salary of £30,000 now pays £450 a year under the new system, compared to £243 a year prior to the changes introduced in 2023/4.

Therefore, if your child or grandchild is starting university in 2024, they are likely worse off than those who enrolled earlier. Although, this will depend upon their income.

More significantly, while it is unlikely that the terms of loans will be changed retrospectively, repayment thresholds could change, either reducing or increasing. This means your child or grandchild could end up paying either more or less in the future.

You could alleviate the graduate tax by paying for your child’s fees

While it might be easier to think of it as a graduate tax, there is clearly still a cost to pay when using student loans, where the borrower earns more than the repayment threshold. That is why you may be considering paying these costs for your child or grandchild entirely.

This may be more cost-effective for them, because it means they will not have to pay money back to the SLC from their income in future. There will be no interest charged either, because there was no money borrowed.

In turn, this could help them make the most of their earnings, rather than paying back a portion of their income each month – even if this is limited to 9% above whichever threshold they are subject to.

However, it is important to note that paying for fees in full could end up costing more, for example if the individual’s income remains below the repayment threshold for significant periods during their working life.

Interestingly, there may be Inheritance Tax (IHT) benefits in paying for your child or grandchild’s university fees, too.

Using your wealth to do this could reduce the total size of your estate. If you exceed key IHT limits, doing so could help your family pay less IHT when you pass away.

Furthermore, gifts to your family are potentially exempt from IHT if you gift regular money directly from income. This must not affect your standard of living.

This could allow you to pay their maintenance costs at university, allowing you to make these gifts free from IHT.

So, it may be beneficial for both you and them to pay for their education, depending on their circumstances.

Grandparents – consider paying fees through offshore bonds to maximise tax efficiency

Offshore bonds offer a tax-efficient method for covering university costs, as no UK taxes are due on income or capital gains until you withdraw the funds. This makes them particularly beneficial if you are managing a discretionary trust, allowing income and gains to be deferred during the investment period.

You can assign policy segments of the bond to your grandchild to cover university expenses. When cashed in, any taxable gains will be taxed in your grandchild’s name, enabling them to make use of their unused personal tax allowances. Students with minimal income can utilise up to £18,570 per year in allowances, potentially accessing up to £55,710 tax-free over a three-year degree—sufficient to cover both tuition and living costs.

This approach can also be applied to school fees or repurposed for other important life events, such as buying a first home. However, this strategy is only effective if you, as the settlor, are a grandparent, not a parent.

The most cost-effective choice will depend on your circumstances and preferences

Ultimately, the most cost-effective choice between paying for your child’s fees, or your child taking out a student loan, will come down to your personal circumstances.

It will almost certainly be more cost-effective for them if you pay the costs upfront.

Meanwhile, if you have a sizable estate and plan to gift your child or grandchild money in future anyway, this could be a highly tax-efficient way to do so for IHT purposes.

That said, as student loans do not function as normal borrowing does, it may not be the hefty weight it appears to be.

It could also be a useful tool for teaching your child or grandchild the importance of budgeting and careful spending. Knowing that they will have the graduate tax to pay in future could mean they are more careful with the money they earn after university.

Of course, you could always get the best of both worlds, perhaps paying for their maintenance costs while they take out a student loan for tuition fees. This will reduce the total amount they owe back, while still giving them a helping hand financially.

Get in touch

If you would like support organising your wealth for the benefit of your family, please do get in touch with us at Pro Sport.

Email enquiries@prosportwealth.co.uk or call 01204 602 909 to speak to an experienced member of our team.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax or estate planning.