You’ve likely just paid your tax bill at the end of January after filling out your self-assessment tax return.

As a professional footballer, you know that tax is part and parcel of what it means to earn your living from the modern game. Even so, your self-assessment tax return may have come as an unwelcome reminder of the amount of tax that you have to pay.

You may have paid tax on the benefits your club provided to you and then included on your P11D form. Agent fees, in particular, can easily run your bill up into the tens of thousands of pounds.

Carry on reading to find out everything you need to know about the taxable benefits on your P11D form, including how this works, why it matters, and what you can do to reduce your tax bill.

A form to declare your taxable benefits

The benefits reported on your P11D may well have made up a significant portion of your tax bill.

A P11D is a tax form filled out by employers with the details of any expenses and benefits given to their employees.

So, as a professional footballer, the form is filled out by the club you play for with a list of any expenses and benefits you’ve been given as an employee.

Each year, your club will submit a P11D form to HM Revenue & Customs (HMRC) by the deadline on 6 July.

You may recall receiving your copy of this form in July, showing you exactly what you’d received in benefits and the amount you owed in tax on these.

You’ll then have paid the resulting tax bill by the deadline on 31 January.

Various benefits may be included on your tax bill

There are several different expenses and benefits that your club may provide that may need to be included on a P11D each year. Some players mistakenly believe that benefits provided by their club don’t incur tax. However, in reality, many are taxable.

This could include:

- Agent fees. Typically, a club will pay your agent’s fees for you.

- Insurance, such as sports injury cover. Your agent may have arranged for this to be included in your contract.

- Accommodation for you and your family. They may provide you with a living allowance or a contribution towards rent costs. This is particularly useful if you’re relocating or you’re an overseas player.

It’s no doubt useful for a club to pay for your benefits, as it means you’re responsible for just the tax, rather than the total cost of what you receive. Ultimately, this does save you money.

Even so, it can still be quite a shock when you receive your P11D in July and see how much tax you owe if you’re not prepared for what’s coming.

Club-funded agents’ fees can result in a particularly hefty tax bill

Agent fees in particular can lead to a significant tax bill. Here’s an example:

- A player agrees to pay an agent 5% of their wages in their representation contract.

- The agent then goes to the club and negotiates a deal for the player of £20,000 a week – that’s around £1 million a year.

- That means the agent’s fees will be around £50,000.

- When the agent comes to make this deal with the club, the club agrees to pay the £50,000 of agent’s fees on behalf of the player.

- This means the player won’t have to pay the full agent fees. However, this would be considered as them receiving a “benefit in kind”, meaning they would owe tax on it.

In the past, the club and the player would have reported this to HMRC as them having split the agent’s fees between them. This saves the player part of their tax bill, seeing them owe additional-rate Income Tax at 45% on just half of the agent’s fees.

That means they’d receive a P11D form with a tax bill of around £11,250 in July, to be paid the following January.

However, HMRC have recently challenged and changed the rules on this, stating that the amount of tax a player pays must marry up with the fee they agreed on their representation contract with the agent.

In this instance, this is the 5% fee initially agreed, so the player would receive a P11D form with a £22,500 tax bill on it instead.

These rules will come into effect on player contracts moving forwards, meaning many players could see the tax they pay for their agent’s fees effectively double.

This makes it all the more important to be aware of the bill you’ll potentially face in January, so you can do something about it.

3 ways you could reduce your tax bill

If there’s tax due on agents’ fees your club has paid, as well as any other benefits that you receive from your club, that tax bill can quickly add up.

Here are three things you could consider doing to reduce your tax bill.

1. Pay your bill throughout the year

The first thing you could consider is arranging to pay a part of your bill each month pro rata – that is, throughout the year. This can be coded out by your accountant.

While this strategy wouldn’t reduce the total amount of tax you’d owe, you would be able to pay the bill over the year rather than in one go.

In the example above, that would turn the £22,500 tax bill into 12 payments of £1,875 to be paid each month.

This can help reduce the direct impact of the bill on your finances, allowing you to keep living your current lifestyle without having to pay a bill in the thousands of pounds at the start of the year.

Speak to your accountant if you’d like to find out more about this option.

2. Choose tax-efficient investments to offset your tax bill

If you already have investments in the stock market, you could consider exploring tax-efficient investments to offset your tax bill.

Before you choose this option, bear in mind that it may involve higher-risk investments that might mean you get back less than you invest.

But, if you’re willing to take on this extra risk, this could be an effective way to reduce how much tax you ultimately have to pay.

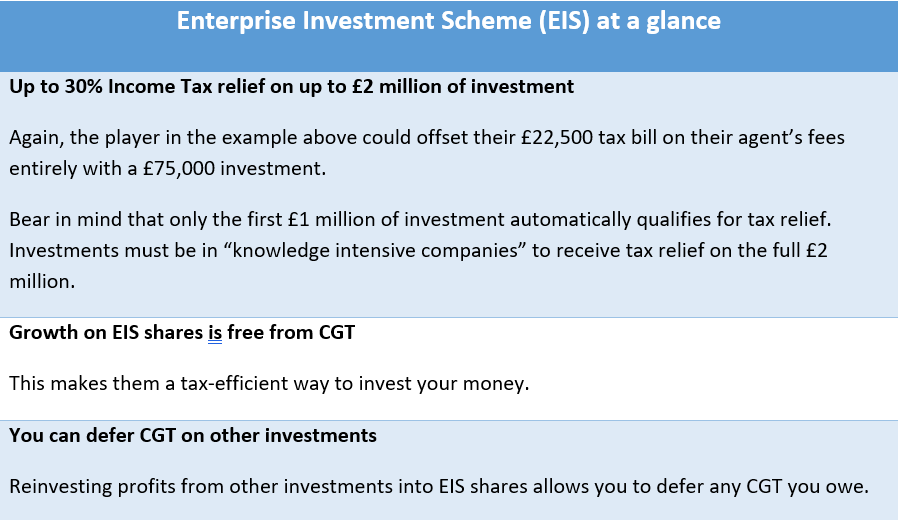

Venture Capital Trusts (VCTs) and the Enterprise Investment Scheme (EIS) are two such investment vehicles that can help you reduce your tax bill.

Before you invest in VCTs, there are a few key points to bear in mind:

- There are eligibility rules for tax relief. You must hold your investment for at least five years and the investments must retain VCT-qualifying status to be eligible.

- VCTs have short windows to invest. VCTs only raise funds periodically, meaning you’ll need to act quickly to invest.

- VCTs investments are high risk. You’ll need to be able to tolerate increased levels of risk, and you may get back less than you invest.

There are a few important considerations for EIS investments, too:

- There are eligibility rules for tax relief. You must invest for at least three years and your investment must retain EIS-qualifying status to be eligible.

- EIS investments are highly illiquid, meaning you won’t be able to access your investment easily. As your wages and circumstances can change quickly, EIS investments may not provide you with the flexibility you need.

- EIS investments are high risk. Much like VCTs, EIS shares are higher risk, and you may get back less than you invest.

Make sure you take financial advice before investing in either VCTs or the EIS.

3. Work with a professional

Realistically, when it comes to saving a tax bill, there’s no substitute for working with an experienced financial planner who knows football inside and out. That’s why you should consider working with us at ProSport.

We’ll help you to find the most appropriate strategies to limit the tax you pay.

This financial certainty can give you the freedom to make smart decisions with your finances in other areas, allowing you and your family to make the most of the money you’ve earned.

Get in touch

If you’d like to find out how we can help you to manage your tax position, please do contact us at ProSport.

Email enquiries@prosportwealth.co.uk or call 01204 602909 to speak to us.

Please note

The Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) are typically suitable for UK-resident taxpayers who are able to tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.

Share values and income generated by the investments could go down as well as up, and you may get back less than you originally invested. These investments are highly illiquid, which means investors could find it difficult to, or be unable to, realise their shares at a value that’s close to the value of the underlying assets.

Tax levels and reliefs could change and the availability of tax reliefs will depend on individual circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.